October 1st marks the date for the opening of the application period for Free Application for Federal Student Aid (FASFA). This 100-question, 10-page form is completed annually by 18 million students of the 20 million students enrolled in colleges in this country. There are an expected four million college graduates this year that will join the almost 44 million Americans who are responsible for over $1.6 trillion in student debt. Since 2008 the cost of a four-year degree increased by 25% and student debt by 107%.

College grants and scholarships have a long history dating back to the 1800s, yet it was in 1958, and the Cold War era, that stoked fears that the United States was trailing its rivals overseas. This prompted Congress to create the National Defense Education Act which granted students scholarships and loans from the federal government to go to college.

As time progressed, the Higher Education Act of 1965 came to be. This gave grants to students based on their income opening the door to, and dramatically expanding, the opportunity for many more to receive their college education. The Reagan Era brought us cuts and limitations that threatened state budgets and college subsidization. Though the costs of college continued to rise, governments continued to cut funding.

In 2018, state funding for two-year and four-year colleges was more than $7 billion — but less than what it was in 2008.

Intriguing is the fact that more than 30% of borrowers are in default or have stopped making payments within six years of graduating college. Pre-1980s, people would work through school and pay off their loans as they went to graduate college with minimal, if any, debt. That trend has subsided more and more as the years progressed.

The last two years have given us college debt forgiveness, from the government, again and again. A popular program, the Public Service Loan Forgiveness program (PSLF) allots forgiveness to graduates that, upon graduation are employed by a federal state, local, or tribal government, or non-for-profit organization for ten years and who continue to make payments on their debt until those ten years are up.

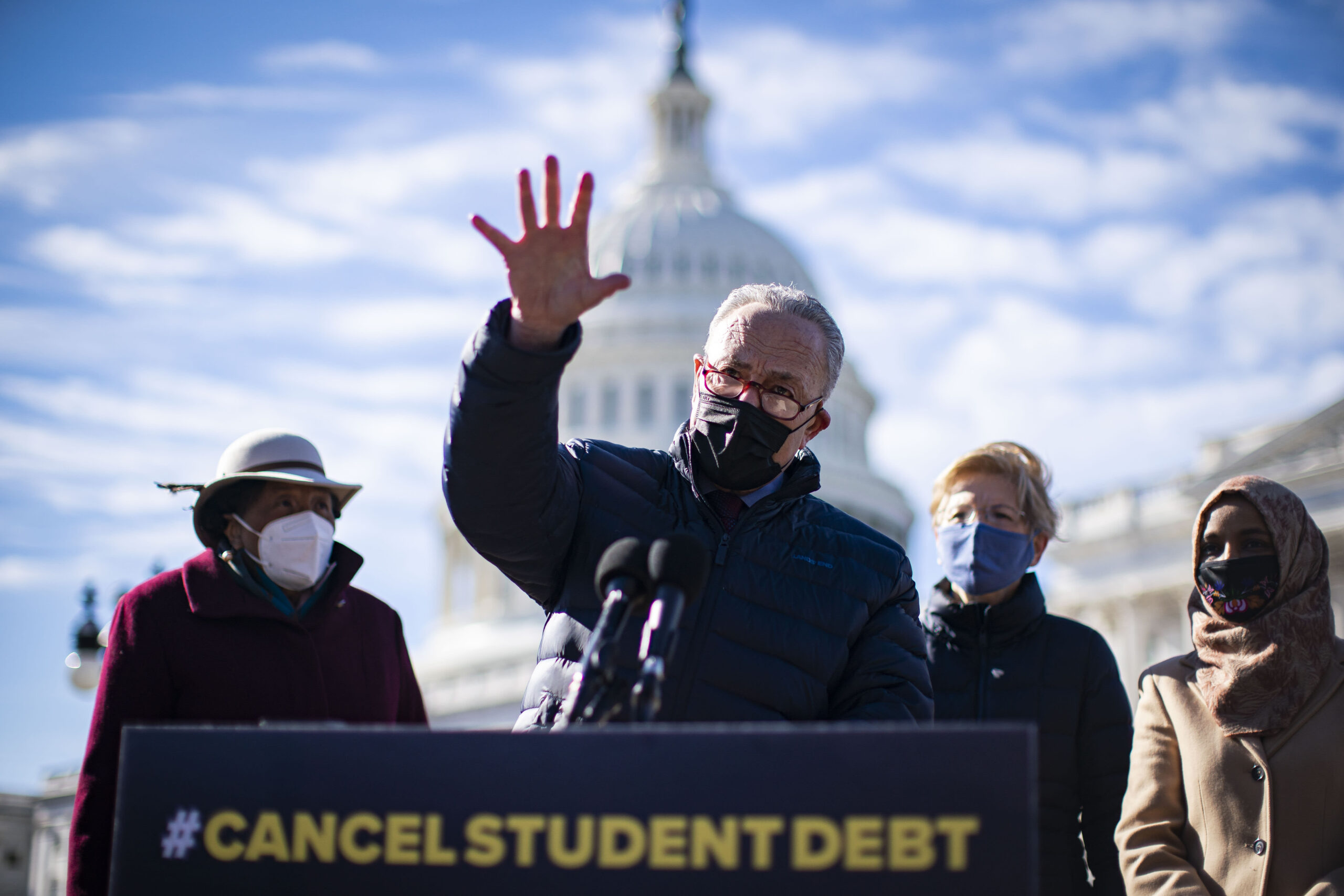

During COVID there was the $2 trillion economic stimulus package which froze student debt interest and payments, followed by a package the House Democrats passed in May that would cancel up to $10,000 in college debt for qualifying participants (a program currently frozen in the Senate).

Biden’s current federal student loan debt portfolio will end up costing taxpayers $68 Billion. Extremely high default rates, fewer graduates making the effort to pay back their debt incurred, and ever-rising costs of college tuition begs the question why? Why is the government looking to have taxpayers pay the bills for life and career choices of others? At what point do our lives and debts become the responsibility of the government?

On average, college graduates earn more than non-college graduates. More and more occupations require a college education. College attendance provides opportunity for growth and for students to receive guidance and support in career choices, as well as providing an opportunity for those in poverty to break the cycle and promote social mobility.

The benefits that come with attending college are undeniable, but why is it that over the previous two decades the responsibility for payment has shifted from student to taxpayer? The idea that college is for everyone and that every child should pursue post-secondary education is harming our society. And to think that strangers, fellow citizens, should foot the bill for those who do decide to attend college is asinine.

The purpose of government is to protect its citizens and to provide opportunities for success and happiness, it is not the role of government to guarantee equality of outcome. College exists for all and due to the plethora of scholarship, grant, and loan opportunities anyone can attend college. Just as you wouldn’t buy a house and expect your neighbor to pay for it, and not be able to live in it, nor should a person choose to attend college and expect everyone else to pay for it.

The cost of secondary education is extreme and has risen to points that are close to unobtainable for some (look at Columbia University with an annual price tag of over $85,000) and that is where the government could intercede and provide regulation or stipulations that would guarantee equal opportunity to all institutions for all students, in lieu of paying off their debts.

The college debt crisis will only continue to grow while deans and professors are earning $100,000 to $200,000 dollar salaries, coaches are earning in the millions, and attendance numbers continue to rise.

Community colleges, vocational education, and trade schools offer students an opportunity to train for a trade. They offer in-depth knowledge of career-specific attributes and skills. Tuition is cut in a third or even half, there’s typically a shorter timeline to graduation, and students don’t take classes unrelated to their career path. These are great opportunities for people also that may not be able to afford college or have the desire to follow a four-year college path, yet we rarely see these choices advocated for. The income opportunities for graduates from a vocational training are often comparable to those graduating college and have as much chance for advancement and growth.

Biden’s proposals to forgive student loan debt will not solve the growing problem. Students will only continue to attend colleges and accrue debt and free college will only promote lower retention and graduation rates, thus degrading the value of the education.

The goal should be to change the public perception, to bring back individual responsibility for decisions and choices one makes. If a person decides to attend a four-year college, the debt should be their responsibility. Increasing programs to help alleviate the weight of the cost is important, like the PSLF, monitoring and regulating costs put out by institutions is an option.

It’s not a college course, but learning to pay your own way is a valuable lesson.

That is the message. This is The Messenger.