On Sunday, the Senate Democrats voted to pass the Inflation Reduction Act, which will ultimately approve the $430 billion bill that primarily covers climate, tax and healthcare after a lengthy negotiation process.

Democrats failed to pass the Build Back Better bill, which would have cost at least $3 trillion, last year due to opposition from Democrats like Senator Joe Manchin (D-W. Va) and Senator Kyrsten Sinema (D-AZ).

Senate Majority Leader Chuck Schumer (D-NY) and Senator Joe Manchin (D-W. Va) proposed the Inflation Reduction Act last week after months of prolonging.

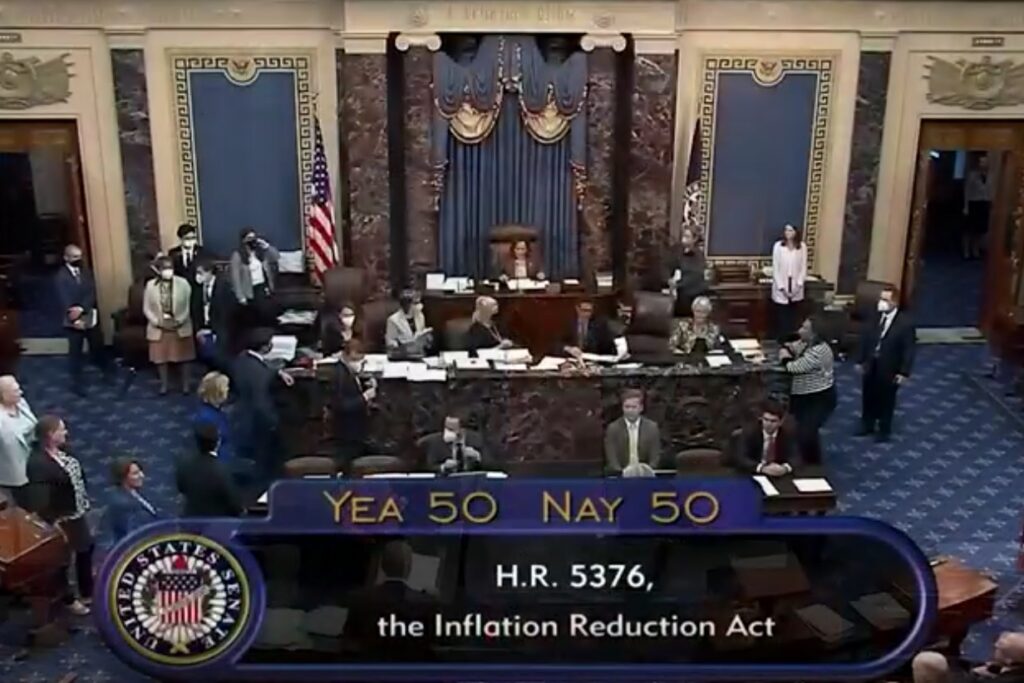

The Senate was divided in half– all 50 Democrats voted for the bill, and all 50 Republicans voted against it. The tie-breaking vote was no less than Vice President Kamala Harris, as the president of the Senate.

This bill is now headed to the House of Representatives. A finalized decision is expected to be made by Friday. Should this bill be approved in the House, President Joe Biden would pass it into law.

The passing of this bill is a big win for Democrats, but what does the Inflation Reduction Act truly entail?

The new legislation reduces the price of prescription drugs, increases taxes on companies, and makes the most significant investment in climate change mitigation in American history.

Here are the main components of the Inflation Reduction Act:

- Taxes and Corporations: Companies will now pay 15% more in taxes if their annual revenue is at least $1 billion. Corporation stock repurchases will be subject to an excise tax of 1%.

- Healthcare and Prescription Drugs: Medicare will be able to negotiate the cost of some prescriptions, lowering the cost that beneficiaries will pay for their meds. Starting in 2025, Medicare enrollees’ annual out-of-pocket expenses for prescription drugs will be capped at $2,000.

- IRS Reform: The IRS has expressed its concern about being underfunded and unable to yield to its demands for many years. $80 billion will be invested into the IRS over the next 10 years.

- Climate Change and Energy: $370 billion will be authorized for energy and climate programs to reduce greenhouse gas emissions to 40 percent by the end of this decade. There will be a significant push to stick to the use of wind, solar, hydro and other renewable power sources, including the cooling and heating of homes. A substantial shift from gas to electric cars is also expected.

Democrats say the federal deficit would be cut by $300 billion over the next decade and modestly ameliorate inflation in future years.

On Saturday, the Executive Office of the President released a statement regarding the Inflation Act: “In all, the bill would reduce the deficit by more than $300 billion, including near-term deficit reduction that, according to a range of economic experts, would also reduce near-term inflation.”

However, the top Republican on the Senate Finance Committee, Senator Mike Crapo (R-ID), strongly disagrees. “It does nothing to bring the economy out of stagnation and recession,” said Senator Crapo. “But rather, the Inflation Reduction Act of 2022 gives us higher taxes, more spending, higher prices – and an army of IRS agents.”

“Taxing the rich” is quite tricky when the rich are those who know tax law, evade taxes, and some even base their businesses out of locations such as the Bahamas to avoid paying taxes.

The people who will be stuck with the bill are the lower and middle class.

Everything costs more these days; food, clothing, gas, you name it– inflation affects everybody, from the poorest to the wealthiest American.

“87,000 more IRS agents will cost small businesses and middle-class families more money than they can afford,” Andrew Garbarino (R-NY-02) told The Messenger on Wednesday. “This couldn’t come at a worse time for American families as President Biden’s inflation has led to families across Long Island paying more for their groceries and more at the pump.”

The COVID-19 pandemic halted normal life for nearly two years. In March 2020, the $2.2-trillion stimulus package was passed. Eligible recipients received a payment of $1,400 ($2,800 for married couples), plus another $1,400 per child under 17. However, these payments significantly changed for higher-income taxpayers with and without children.

Researchers at the Federal Reserve Bank of San Francisco released a study this past March revealing that the stimulus checks increased U.S. inflation by roughly 3 percentage points at the end of 2021.

But there are many other causes of inflation in 2022, despite the lack of accountability.

The GDP declined by 1.6 percent in the first quarter and 0.9 percent in the second quarter. The Biden Administration has not taken full responsibility for the current state of the economy, often blaming the Russia-Ukraine conflict, oil companies and small business owners.

It is undebatable that the U.S is in recession. The major stock market indices have seen double-digit declines in 2022.

Does the Inflation Reduction act truly have an impact on inflation?

The University of Pennsylvania, Penn Wharton Budget Model (PWBM) displayed low confidence in the Inflation Reduction Act.

PWBM used an “impulse response” model to measure the impact this bill will have on inflation– the model is typically used in economics.

“We estimate that the Inflation Reduction Act will produce a very small increase in inflation for the first few years, up to 0.05 percent points in 2024,” states the study. “We estimate a 0.25 percentage point fall in the PCE price index by the late 2020s.”

“These point estimates, however, are not statistically different than zero, thereby indicating a very low level of confidence that the legislation will have any impact on inflation,” the study concludes.

The Biden Administration will stop at nothing to erase their economic mistakes by making hard-working, taxpaying Americans pay the price. The Inflation Reduction Act is a forecastable failure in the Administration’s attempt to “Build Back Better.”